| Country | Hungary |

|---|---|

| Sector | Retail, Consumer & Leisure |

| Deal type | Carve-out |

| Investment date | June 2011 |

| Status | Realized investment |

| Exit method | Sale to Pamplona Capital Management (July 2015) |

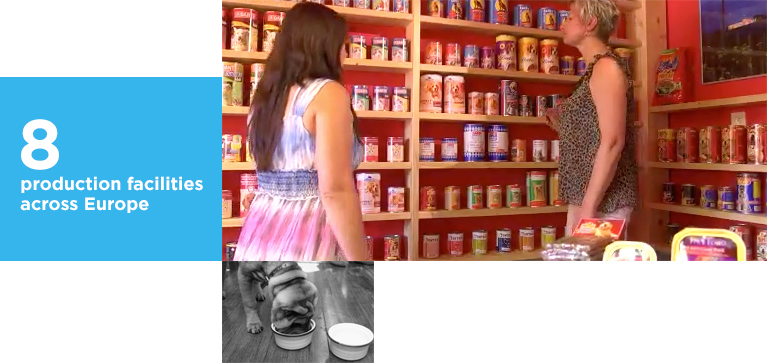

Partner in Pet Food (PPF) is one of Europe’s largest producers of private-label pet food, supplying customers in over 37 countries. The company offers a full range of high-quality cat and dog food products, including dry and semi-moist food, cans, alucups, pouches, snacks and cat milk. Headquartered in Budapest, PPF employs approximately 1,200 staff and has eight production facilities across Europe.

TAPPING FAST-GROWING MARKETS

In 2011, Advent International acquired PPF from Provimi Group, a Netherlands-based animal nutrition company. “PPF represented a relatively small percentage of Provimi’s revenue in a non-core category, and we felt we could help this established leader become a more focused player by carving it out from its parent,” recalls Chris Mruck, an Advent managing partner based in Prague.

One of the investment’s key attractions was the high-growth pet food market, particularly in Central and Eastern Europe, where the company had the strongest presence. Factors driving growth in CEE included rising consumer purchasing power and acceptance of private-label goods, along with demographic changes leading to higher pet ownership. In addition, we saw opportunities to optimize PPF’s operations and increase its role in the premium and super-premium categories.

EXPANDING THE PREMIUM

PET FOOD BUSINESS

In the first 100 days after our acquisition, we worked with the management team to establish standalone IT and finance functions, rebrand the company, divest a loss-making French subsidiary and hire a new CFO, group lead buyer for commodities and two country general managers. Since then, the team has driven growth and margins through product innovation, operational improvement and expansion of PPF’s footprint across Europe.

- Product innovation—In line with its strategy of shifting upmarket, PPF is focusing on developing single-serve products. With its 2013 acquisition of Agro-Trust, PPF entered the premium, alucup pre-packaged segment, resulting in double-digit sales growth. The company has also improved its existing product mix, expanding margins significantly.

- Operational improvement—Gains in production, logistics and procurement efficiency have already led to significant cost savings, and more are expected in the coming years. PPF has also improved operations in its Dutch business.

- Strengthening and broadening presence across Europe—In 2013, PPF entered new markets in Ukraine and Italy and increased its presence in the United Kingdom, Germany, France, Slovenia and Croatia. Building on its long-standing relationship with British retailer Tesco in Central and Eastern Europe, the company signed a new agreement to supply private-label products to Tesco’s UK stores. This major milestone was a key factor in Western Europe becoming the fastest-growing geography for PPF in 2014.

All of these initiatives have led to solid revenue and earnings growth at the company. PPF generated sales of €235 million in 2014, a strong double-digit increase since 2011, the year of our investment. EBITDA has risen even faster during the same period.

“Advent helps challenge our company and brings the right questions to the table,” says PPF CEO Attila Balogh. “Their deep understanding of our business, particularly on the operations side, helped us refocus on lowering costs, the most competitive edge you can gain in the private-label market.”

After working closely with PPF's management on operational improvements and product innovation, we began looking for a new partner that could help PPF set the stage for future growth. In July 2015, we completed the sale of PPF to Pamplona Capital Management.

Looking forward, PPF is positioned to grow strongly in the private-label market, where its pan-European capabilities map the footprint of the largest retailers and provide significant economies of scale in product development and procurement. Moreover, the company’s broad geographic spread results in low customer concentration, a critical feature of a resilient private-label business.

“We’re aiming to become the No. 1 pet food company in Europe, by offering our retail partners the best quality-to-price ratio, excellent service—including full category management—and truly innovative products,” said Balogh. “We expect to increase EBITDA significantly over the next three to five years through a combination of organic growth and acquisitions, and we’re excited about entering our next phase of growth in partnership with Pamplona.”

Retail, Consumer & Leisure

Retail, Consumer & Leisure